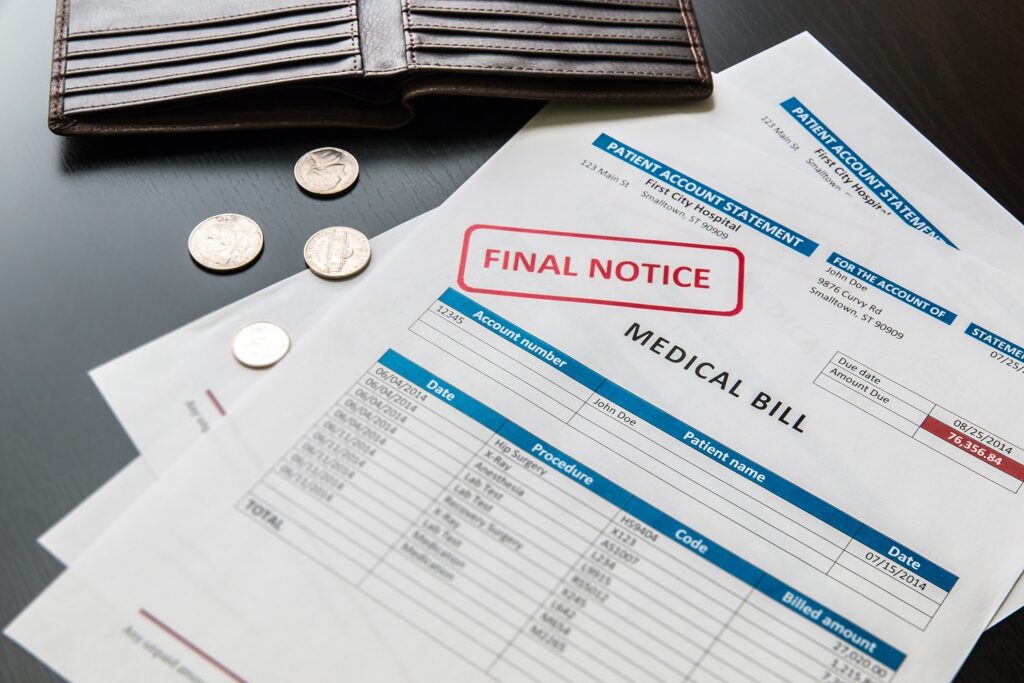

Unpaid hospital bills can create significant financial and emotional stress. These debts don’t just disappear—they can lead to collections, legal action, credit score damage, and in some cases, financial hardship that lingers for years. Medical debt remains a leading cause of financial challenges for millions, affecting their ability to access essential services or secure loans. Yet, many people are unaware of their rights, assistance programs, or strategies to negotiate and reduce medical bills.

We’ll break down everything you need to know about unpaid hospital bills. From legal consequences and credit implications to payment strategies and hospital forgiveness programs, this article provides actionable insights to help you manage medical debt and avoid long-term consequences.

The Repercussions of Ignoring Hospital Bills

Failing to pay hospital bills can lead to serious consequences that impact your finances and overall well-being. Here’s what you need to know:

1. Late Fees and Penalties

- Hospitals may impose late payment fees or interest charges, making your debt grow over time.

- These fees depend on state laws and the hospital’s payment terms.

- Pro Tip: Review billing agreements to understand penalties for late payments.

2. Damage to Your Credit Score

- Unpaid hospital bills sent to collections can significantly harm your credit score.

- As of 2023, unpaid medical debt under $500 no longer impacts credit reports, but larger amounts will.

- Credit damage can make it harder to secure loans, rent homes, or even land a job.

3. Debt Collection Hassles

- Hospitals often transfer unpaid bills to third-party collection agencies.

- Expect frequent calls, letters, and emails from collectors.

- Collection agencies must follow legal guidelines—no harassment or threats.

4. Legal Action and Wage Garnishment

- Hospitals can sue for unpaid bills.

- If they win, the court may allow them to garnish your wages or seize bank assets.

- Legal actions can compound stress and financial instability.

What to Do If You Can’t Pay Hospital Bills

Avoiding the consequences of unpaid medical debt requires action. Here’s what you can do:

1. Verify the Accuracy of Your Bills

- Request an itemized bill from the hospital to confirm all charges.

- Look for common errors, such as:

- Services not received

- Duplicate charges

- Miscoding of procedures

- Compare your bill with your insurance company’s Explanation of Benefits (EOB).

2. Negotiate Your Medical Bills

- Contact the hospital billing department to negotiate payment terms or request discounts.

- Ask about financial aid programs or uninsured patient discounts.

- Offer a lump-sum payment upfront to potentially secure a “quick-pay” discount (15-20% off in many cases).

3. Seek Financial Assistance

- Hospitals often have charity care programs for low-income individuals.

- Apply for Medicaid or other government assistance programs if eligible.

- Use nonprofit organizations like the Patient Advocate Foundation to help with appeals and disputes.

4. Use Payment Plans

- Most hospitals offer interest-free payment plans to spread out costs over time.

- Set up manageable monthly payments to avoid collection agencies.

5. Work with a Medical Billing Advocate

- A medical billing advocate can:

- Negotiate lower bills

- Correct billing errors

- Represent your interests with insurers and providers

How Unpaid Medical Bills Affect Your Life

1. Emotional and Mental Stress

- Constant calls and legal threats from collectors can cause severe stress.

- Many patients experience anxiety and depression due to financial strain.

2. Access to Future Medical Care

- Some hospitals may require upfront payment if you have outstanding debts.

- This can limit access to necessary treatments or procedures.

3. Bankruptcy as a Last Resort

- Medical debt is a leading cause of bankruptcy in the U.S.

- Filing for bankruptcy can wipe out hospital bills but impacts your credit for up to 10 years.

- Speak to a bankruptcy attorney before considering this step.

Legal Protections for Patients with Unpaid Bills

Patients have rights, even when they owe money.

1. No Surprises Act

- Protects against surprise bills for emergency services or out-of-network care without prior notice. Want to know more about avoiding a medical dispute. Click here.

2. Fair Debt Collection Practices Act (FDCPA)

- Prohibits collectors from harassment, threats, or false claims.

3. Credit Reporting Reforms

- Medical debts under $500 no longer appear on credit reports as of 2023.

- There’s a one-year grace period before unpaid medical debt affects credit scores.

Tips to Prevent Hospital Bill Issues

- Plan Ahead: Discuss billing and potential costs with providers before treatment.

- Shop Around: Compare rates for non-emergency procedures to avoid overpaying.

- Use Preventative Care: Regular check-ups and healthy living can reduce costly hospital visits.

Can You Go to Jail for Not Paying Medical Bills?

What Does This Mean?

In the U.S., unpaid hospital bills are treated as civil debts, not criminal liabilities. You cannot go to jail for failing to pay a medical bill. However, ignoring lawsuits or court orders related to the debt may lead to other legal issues, such as wage garnishments.

How to Resolve It?

- Respond to Debt Collection Notices: Never ignore communications about unpaid bills.

- Attend All Court Hearings: If sued, appear in court to avoid contempt charges.

- Seek Legal Counsel: Contact a lawyer or nonprofit legal aid to help negotiate or defend against legal action.

What Is the Minimum Monthly Payment on Medical Bills?

What Does This Mean?

Hospitals and providers often allow patients to break down bills into monthly payments. The minimum payment amount varies depending on the total bill and your financial circumstances.

How to Resolve It?

- Request Payment Options: Call the billing department to discuss interest-free payment plans.

- Calculate a Manageable Amount: Offer a realistic monthly payment based on your income.

- Monitor Payments: Set reminders or automate transfers to ensure you don’t miss payments.

Hospital Bill Forgiveness

What Does This Mean?

Many hospitals offer financial assistance programs to forgive or reduce medical debt for qualifying patients. These programs are often based on income and family size.

How to Resolve It?

- Apply for Financial Assistance Programs: Most hospitals provide charity care or discounts for low-income families.

- Check Eligibility for Government Aid: Medicaid, CHIP, or other programs may retroactively cover expenses.

- Provide Documentation: Submit proof of income, tax returns, or other required documents promptly.

What Happens If You Don’t Pay Your Medical Bills Reddit?

What Does This Mean?

Reddit comes in the top-10 most used platforms on the internet, therefore its discussions are most ranked but the truth is, it’s important to access information from a reliable resource. Upon checking the responses from Reddit about the question, “what happens if you don’t pay hospital bills”, it reveals real-life scenarios of unpaid medical bills, including the stress of dealing with debt collectors, credit score impacts, and lawsuits.

Solutions Found on Reddit to Resolve It?

- Negotiate Directly with Providers: Before the bill is sent to collections, request discounts or payment plans.

- Leverage Credit Reporting Changes: Medical debts under $500 no longer appear on credit reports as of 2023.

- Seek Patient Advocacy: Nonprofit organizations like the Patient Advocate Foundation can help you navigate billing disputes.

What Happens If You Don’t Pay a Hospital Bill From Another Country?

What Does This Mean?

Unpaid medical bills from international providers can complicate matters, especially if travel insurance wasn’t purchased. Most foreign debts don’t directly affect credit in the U.S., but aggressive collection tactics may still occur.

How to Resolve It?

- Contact the Hospital: Request an itemized bill and negotiate a lower amount.

- Research Legal Protections: Understand your rights if the foreign provider attempts to collect in the U.S.

- Plan for Future Travel: Always purchase travel insurance to avoid international medical debt.

How Long Do You Have to Pay Medical Bills?

What Does This Mean?

The timeline to settle medical bills varies by state laws and provider policies. Bills often go to collections after 90–180 days of non-payment.

How to Resolve It?

- Communicate with Providers: Ask for an extension if you need more time to pay.

- Avoid Collections: Pay at least a partial amount to prevent the bill from being transferred to a collection agency.

- Monitor Your Credit Report: Ensure the debt is reported accurately.

What Happens If You Don’t Pay Hospital Bill After Giving Birth?

What Does This Mean?

Childbirth can result in high hospital costs, especially for uninsured patients. Failure to pay can lead to collections and financial stress.

How to Resolve It?

- Apply for Medicaid or CHIP: These programs often cover maternity and postpartum care expenses.

- Negotiate Payment Plans: Hospitals are often flexible with maternity-related bills.

- Explore Charity Care: Many hospitals have specific programs for new mothers in financial distress.

Do Hospitals Write Off Unpaid Medical Bills?

What Does This Mean?

Hospitals may write off unpaid bills as bad debt, but this doesn’t relieve you of your financial obligation. Debt collection agencies often purchase these accounts and pursue payment.

How to Resolve It?

- Request Assistance Early: Qualify for write-offs or discounts before the bill reaches collections.

- Negotiate Settlements: Offer a lump-sum payment to settle the debt for less than the full amount.

- Stay Proactive: Communicate with the hospital and document all interactions.

Strategies to Handle Medical Bills Effectively

Verify Bill Accuracy

- Request an Itemized Bill: Check for duplicate charges or services you didn’t receive.

- Compare with Insurance EOB: Ensure your insurer covered the services as promised.

- Dispute Errors: Contact the provider immediately if discrepancies are found.

Negotiate and Seek Discounts

- Ask for Prompt-Pay Discounts: Many providers offer 10–20% discounts for upfront payments.

- Hire a Medical Billing Advocate: These professionals can negotiate lower bills on your behalf.

Explore Assistance Programs

- Nonprofit Help: Organizations like the Patient Advocate Foundation or RIP Medical Debt can help.

- Hospital Charity Programs: Ask the billing department for income-based relief.

Conclusion: The Cost of Ignoring Hospital Bills

Unpaid hospital bills don’t just disappear—they grow into bigger problems. From credit damage to legal trouble, the consequences can be life-altering. By taking proactive steps—verifying bills, negotiating payments, and seeking assistance—you can regain control of your finances and avoid the long-term impacts of medical debt.

Remember, you’re not alone. Use available resources, stay informed, and act quickly to prevent hospital bills from derailing your life.

If you ever find yourself in trouble, don’t forget to contact us and we can certainly help you get in touch with healthcare lawsuits providers or medlawyers.