Medical insurance verification is an essential step in the healthcare revenue cycle management process. It ensures that patients have valid and active coverage, helps prevent billing errors, and supports the financial stability of healthcare providers. This guide will explore the importance of verifying medical insurance, the steps involved, the best practices for implementing an effective verification system, and the consequences of not verifying insurance details.

What Is Medical Insurance Verification?

Medical insurance verification is the process of confirming a patient’s health insurance coverage, eligibility, and benefits before providing healthcare services. This step ensures that a patient’s insurance will cover the medical services provided and that any out-of-pocket costs are clear upfront. Verification typically involves checking for active coverage, confirming the details of the policy, and ensuring that necessary pre-authorizations or referrals are in place.

For healthcare providers, verification is critical in reducing errors that could lead to claim denials and delayed payments. For patients, it provides peace of mind that their insurance coverage will pay for necessary treatments and services.

Why Is Medical Insurance Verification Crucial?

1. Ensures Accurate Billing and Reduces Claim Denials

One of the primary reasons to verify medical insurance is to ensure accurate billing. Incorrect insurance information, such as an expired policy or a mismatch between the service and the patient’s coverage, can lead to claim denials. According to a study by the American Academy of Family Physicians (AAFP), more than 80% of claim denials are preventable, with inaccurate insurance information being a leading cause.

Verifying the patient’s insurance details helps ensure the claims are submitted correctly and meet the payer’s guidelines, reducing the likelihood of denials.

2. Prevents Revenue Loss and Improves Cash Flow

Medical billing errors due to incorrect insurance information can lead to significant revenue loss. When claims are denied or rejected, healthcare providers must spend additional resources correcting them, which can delay payments for services rendered. By verifying insurance in advance, providers can avoid these costly mistakes and ensure that payments are received promptly.

3. Enhances the Patient Experience and Reduces Financial Surprises

Patients who are informed about their insurance coverage up front are less likely to experience unexpected financial surprises. When insurance verification is completed before services are rendered, patients can make informed decisions about their care, including whether they need to adjust their treatment plans based on their coverage.

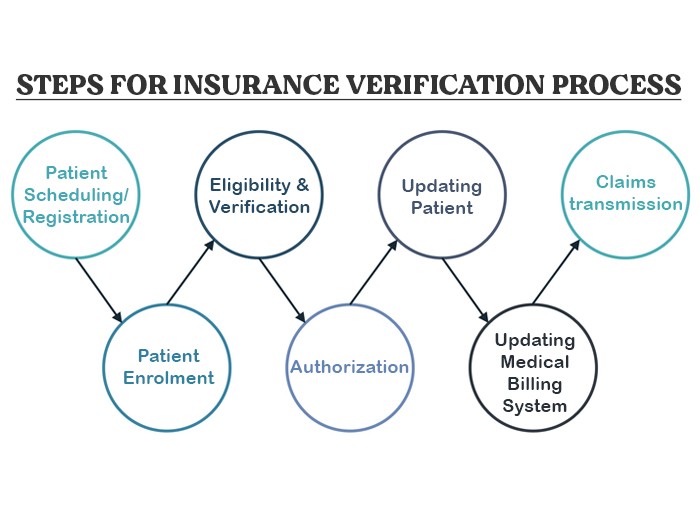

2 Steps Guide for Medical Insurance Verification

Step 1: Collect Essential Patient Information

The verification process starts by gathering basic information from the patient. This includes:

- Full name

- Date of birth

- Insurance policy number

- Insurance company name

- Group number (if applicable)

- Policyholder’s details (if different from the patient)

Step 2: Contact the Insurance Company

Once the necessary information is collected, the next step is to contact the insurance provider. Verification can be done manually by calling the insurer, or through electronic systems that allow real-time verification of coverage.

What Is Checked During Verification?

- Coverage status: Ensuring the policy is active on the date of service.

- Eligibility: Confirming the patient is eligible for the specific medical services they need.

- Co-payments, deductibles, and coinsurance: Determining the patient’s out-of-pocket expenses.

- Service limits: Checking if the insurance plan limits the number of visits or procedures covered.

- Pre-authorization: Identifying whether any procedures require prior approval from the insurance company.

Step 3: Inform the Patient

After verification, it’s essential to communicate with the patient regarding their insurance coverage, including the following details:

- The extent of their coverage and any limitations.

- Any financial responsibility they will have, such as copays, deductibles, and coinsurance.

- If any pre-authorization is required for specific services.

Best Practices for Medical Insurance Verification

1. Use Technology to Automate the Process

The traditional manual verification process can be time-consuming and prone to human error. Modern technology offers automated systems that can speed up verification and reduce errors. Electronic eligibility verification tools allow healthcare providers to instantly check a patient’s insurance status and coverage details in real time.

2. Verify Insurance Information Before Every Visit

To ensure that all information is up-to-date and correct, verification should be done before every patient visit, especially for ongoing treatments. This is particularly important in cases where insurance policies are subject to change, such as annual renewals or job-related plan changes.

3. Maintain Clear Communication with Insurance Providers

Establishing a direct line of communication with insurance providers is crucial. When discrepancies arise or additional clarifications are needed, having a strong relationship with the insurance company can expedite resolution. Additionally, implementing a system that flags discrepancies in real time helps prevent issues from escalating into claim denials.

4. Train Staff Regularly

Since the process of insurance verification involves both clinical and administrative staff, training all team members is essential. Ensuring that everyone understands the insurance verification process, the importance of accuracy, and how to handle common issues can improve efficiency and accuracy in the long term.

5. Review Insurance Verification Procedures Periodically

Healthcare providers should regularly review their insurance verification procedures to ensure they align with the latest industry standards and insurance requirements. This ensures that processes are up-to-date and any inefficiencies or bottlenecks can be addressed promptly.

The Consequences of Skipping Medical Insurance Verification

1. Increased Denial Rates

Failure to verify insurance information can result in claims being denied or rejected, leading to delays in payments. As mentioned, many claim denials are directly linked to incorrect insurance details. Denied claims require time and resources to correct, further delaying revenue collection.

2. Loss of Revenue

Not verifying insurance can result in missed opportunities for payment. If an insurer does not cover certain services or if a patient’s coverage has expired, the healthcare provider may be left with unpaid bills. With rising healthcare costs, this loss can be significant for many practices.

3. Damaged Patient Trust

Unexpected bills due to unverified insurance coverage can lead to dissatisfaction and erode patient trust. Patients expect transparency and clarity regarding their financial responsibilities before receiving treatment. If this step is skipped, patients may feel misled and unhappy with the service.

Technology and Innovations in Medical Insurance Verification

1. Real-Time Eligibility Verification

Real-time eligibility checks are one of the most important technological advancements in the insurance verification process. This allows healthcare providers to instantly verify coverage details and receive approval for services without waiting for days.

2. Artificial Intelligence and Automation

AI-powered systems are increasingly being used to streamline insurance verification. These systems can automatically extract and validate patient data, identify potential issues, and suggest resolutions, improving accuracy and reducing human error.

3. Cloud-Based Verification Systems

Cloud technology allows providers to access insurance verification data from anywhere, improving flexibility and accessibility. Cloud-based solutions also facilitate better data management and integration across systems, reducing the chances of errors.

The Role of Medical Insurance Verification in Revenue Cycle Management

Medical insurance verification is an integral part of revenue cycle management (RCM). Proper verification ensures that claims are submitted correctly and that financial risks are minimized. By catching errors early, providers can reduce the amount of rework required, improve cash flow, and ensure more accurate reimbursement rates.

Major FAQs Related to Medical Insurance Verification

How Often Should Insurance Information Be Verified?

Insurance information should be verified regularly, as it can change frequently. Here are some key guidelines for how often verification should be done:

- Before Every Visit: For routine check-ups or new procedures, it’s essential to verify insurance before each visit. Insurance plans may change annually or if a patient switches jobs or coverage, so checking eligibility each time ensures accurate billing.

- Annually: Even if a patient visits regularly, it’s important to verify their insurance details at least once per year due to policy changes, new coverage, or updated co-pays and deductibles.

- When There Are Changes in Employment: If a patient changes jobs or their employer switches insurance providers, their policy details can change. A new verification should be conducted before their next visit to ensure coverage is valid.

- For Ongoing Treatments: For patients undergoing ongoing treatments, regular verification is key to avoid disruptions in coverage. For example, treatments like physical therapy or chemotherapy might be subject to pre-authorization that must be re-verified periodically.

Real Data: A study from the American Medical Association showed that 18% of patients experience insurance coverage changes each year. Regular verification helps avoid surprises and reduces financial strain on both the provider and the patient.

What Does It Mean When Insurance Is Verified?

When insurance is verified, it means that a healthcare provider has confirmed the patient’s insurance coverage, including the status of the policy and whether the requested services are covered. This involves the following steps:

- Eligibility Check: The provider confirms that the patient is currently covered under the insurance plan.

- Coverage Details: Verification includes checking the type of services covered, whether certain procedures are approved, and understanding any co-pays, deductibles, or coinsurance amounts that the patient is responsible for.

- Active Status: The insurance is verified to ensure it is active on the date of service. If the policy has expired, the provider may seek updated information.

- Pre-authorization Requirements: If any procedure or service requires pre-authorization or referral, this will be confirmed during verification.

Real-Time Data: According to MGMA (Medical Group Management Association), 69% of practices report that verifying insurance eligibility before service helps reduce claim rejections and denials.

Why Is Insurance Always Verified?

Insurance is always verified because it plays a critical role in the financial and operational aspects of healthcare delivery. Here’s why verification is non-negotiable:

- Avoid Denials and Delays: With 45% of claims denied due to eligibility issues or errors in insurance details, verifying insurance prevents delays and denials, ensuring timely reimbursements and reducing the administrative burden.

- Minimize Out-of-Pocket Costs: Insurance verification provides patients with clear financial expectations before treatment, minimizing out-of-pocket surprises and allowing them to make informed decisions about their care.

- Legal and Compliance Requirements: Providers are legally required to bill only for services covered by the patient’s insurance, and verifying eligibility ensures compliance with billing regulations.

- Revenue Cycle Optimization: Healthcare providers who verify insurance at every point of care see a 25% increase in their revenue cycle efficiency, according to RevCycle Intelligence.

What Is the Role of an Insurance Verification Specialist?

An insurance verification specialist plays a key role in the medical office or hospital’s billing and administrative team. Their duties typically include:

- Collecting Insurance Information: Gathering and verifying patient insurance details to ensure that coverage is active and applicable for the services provided.

- Communication with Insurance Providers: Specialists communicate directly with insurers to verify coverage, benefits, and eligibility. This may involve calling insurers, checking databases, or using electronic verification tools.

- Checking Pre-authorization Requirements: Specialists ensure that any necessary pre-authorizations are obtained before treatments are provided, especially for high-cost procedures.

- Resolving Discrepancies: If any discrepancies are found (e.g., inactive insurance or mismatched details), specialists are responsible for resolving these issues before service is rendered.

- Providing Support to Patients: They may also work with patients to explain their insurance coverage and financial responsibilities, ensuring transparency and clarity.

Real-Time Data: A report from The Healthcare Financial Management Association found that over 70% of billing and coding errors can be attributed to improper or incomplete verification, underscoring the importance of the insurance verification specialist’s role in maintaining accuracy.

Final Thoughts: The Importance of Medical Insurance Verification

Medical insurance verification is not only a time-saving step but a necessary one to ensure accurate billing, prevent claim denials, maintain financial health, and protect the patient-provider relationship. By implementing best practices and leveraging technology, healthcare providers can significantly improve the efficiency of their insurance verification process and provide better service to their patients.

As healthcare costs continue to rise, the need for accurate and timely insurance verification has never been more critical. For healthcare providers, implementing robust insurance verification procedures is not just a best practice; it’s essential for financial stability and operational efficiency. By understanding the importance of verification and investing in the right tools and specialists, healthcare providers can ensure they are prepared to meet the needs of their patients while safeguarding their bottom line.

If you don’t have ample time to verify medical insurance, we can do it for you. QZ Medx has a motto of helping out budding providers to manage and file claims to take maximum benefits from insurance.