A superbill is a crucial document in the healthcare industry, serving as an itemized list of all the services provided to a patient during their visit to a healthcare provider. Superbills are primarily used for creating insurance claims, which are then submitted to payers for reimbursement. For patients visiting out-of-network providers, superbills are essential for getting reimbursed by their insurance companies.

How Does a Superbill Work?

When a patient visits a healthcare provider, particularly an out-of-network provider, they pay for the services upfront. The provider then issues a superbill that details the services provided, including procedure and diagnosis codes. The patient submits this superbill to their insurance company to get reimbursed for the out-of-pocket expenses.

The insurance company reviews the superbill and decides how much, if any, they will reimburse based on the patient’s plan details, including deductibles, co-payments, and coverage limits.

Importance of a Superbill

Superbills play a vital role in the medical billing process, especially for out-of-network services:

- For Patients: Superbills help patients get reimbursed for the healthcare services they receive from out-of-network providers. Without a superbill, patients may not be able to claim any reimbursement from their insurance company.

- For Providers: Superbills allow healthcare providers to get paid upfront by the patients, reducing the time spent on waiting for insurance claims to be processed. This ensures better cash flow and financial stability for the practice.

Common Reasons for Claim Denials

While superbills streamline the reimbursement process, there are still common reasons for claim denials:

- Eligibility Issues: If the patient’s insurance coverage is not active or does not cover the services provided.

- Coding Errors: Incorrect or incomplete coding can lead to claim denials. Accurate CPT and ICD-10 codes are crucial.

- Duplicate Claims: Submitting the same claim more than once can result in denials.

- Lack of Pre-Authorization: Some services require pre-authorization from the insurance company, and failing to obtain it can lead to denials.

- Insufficient Documentation: Missing or incomplete documentation can prevent the insurance company from processing the claim.

How to Create a Superbill

Creating a superbill involves several steps, and it’s crucial to get every detail right to avoid claim denials. Here’s a step-by-step guide:

- Enter Patient Information: Include the patient’s name, address, phone number, date of birth, and insurance details.

- Enter Provider Information: Fill in the provider’s name, NPI number, office location, contact information, and signature.

- Document Visit Details: Record the date of visit, and include all relevant CPT and ICD-10 codes, modifiers, units or minutes, and fees charged.

- Double-Check for Accuracy: Ensure all information is accurate and complete. Any errors or omissions can lead to claim denials.

- Provide the Superbill to the Patient: Once the superbill is complete, provide a copy to the patient so they can submit it to their insurance company for reimbursement.

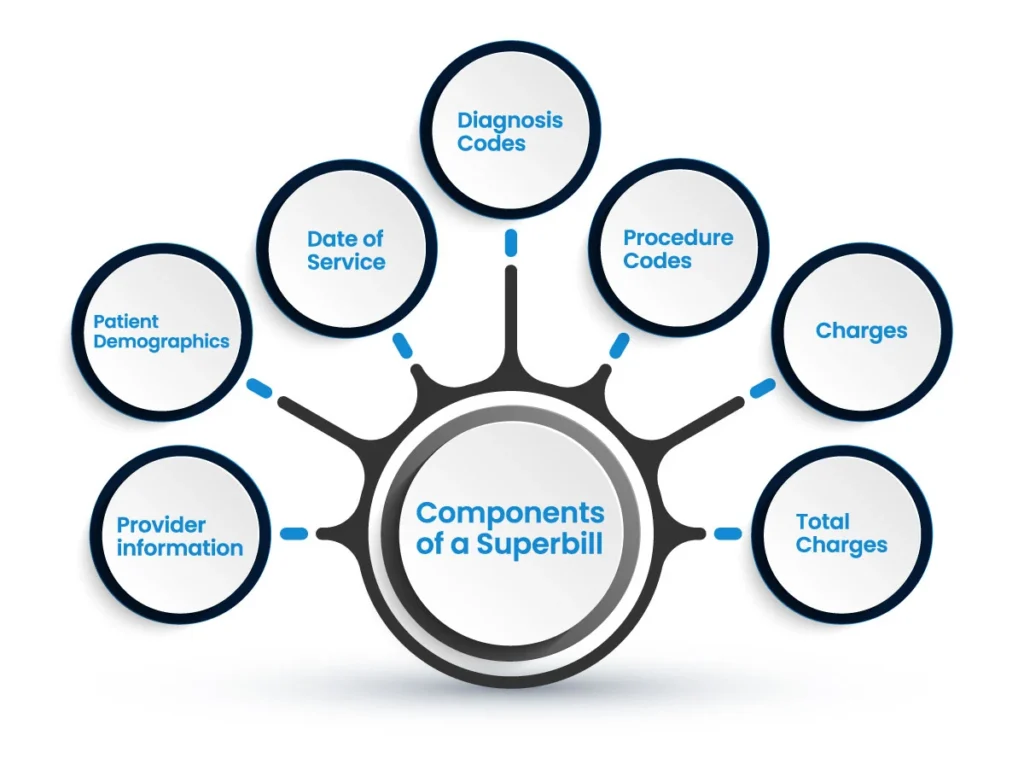

Detailed Breakdown of Superbill Components

Provider Information

The provider section of a superbill includes critical details about the healthcare provider. Accurate provider information is essential for the insurance company to validate and process the claim correctly. Here’s what should be included:

- Provider’s Name: Full legal name of the healthcare provider.

- National Provider Identifier (NPI): A unique 10-digit identification number issued to healthcare providers in the United States by the Centers for Medicare and Medicaid Services (CMS).

- Office Location: The physical address where the healthcare service was provided.

- Contact Information: Provider’s phone number and email address for any follow-up or verification.

- Provider’s Signature: A signature is often required for verification purposes.

- Referring Provider Details: If applicable, include the name and NPI number of any referring provider who recommended the service.

Patient Information

Accurate and comprehensive patient information is vital to ensure the insurance company can correctly identify the patient and link the superbill to the appropriate insurance policy. This section should include:

- Patient’s Name: Full name as listed on the insurance policy.

- Residential Address: The patient’s home address.

- Contact Number: A phone number to reach the patient.

- Date of Birth (DOB): The patient’s date of birth.

- Insurance Information: Details such as insurance provider, policy number, and group number.

Visit Information

This section of the superbill provides a detailed account of the patient’s visit. It includes:

- Date of Visit: The exact date when the healthcare service was provided.

- Procedure Codes (CPT): These codes describe the medical procedures performed during the visit. They standardize the services provided to ensure consistent billing.

- Diagnosis Codes (ICD-10): These codes describe the patient’s diagnosis and are essential for insurance purposes.

- Modifiers: Additional codes that provide more details about the procedures performed.

- Units or Minutes: The amount of time spent on each procedure or service.

- Fees Charged: The costs associated with each service provided.

Understanding CPT and ICD-10 Codes to do Accurate Medical Coding

Current Procedural Terminology (CPT) Codes

CPT codes are a critical part of the medical billing process. They are maintained by the American Medical Association (AMA) and are used to describe the procedures and services performed by healthcare providers. These codes standardize the billing process, making it easier for insurance companies to understand and process claims.

International Classification of Diseases (ICD-10) Codes

ICD-10 codes are used worldwide to classify diseases, conditions, and other health-related issues. In the United States, the ICD-10-CM (Clinical Modification) codes are used for diagnosis coding, while the ICD-10-PCS (Procedure Coding System) codes are used for inpatient hospital procedure coding. These codes provide a standardized way of reporting and billing for healthcare services.

The Importance of Accurate Coding

Accurate coding is essential for several reasons:

- Prevents Claim Denials: Incorrect or incomplete codes can lead to claim denials, which can delay reimbursement and require additional administrative work to correct.

- Ensures Proper Reimbursement: Accurate coding helps ensure that healthcare providers are reimbursed correctly for the services they provide.

- Compliance with Regulations: Proper coding is necessary to comply with healthcare regulations and avoid potential audits or penalties.

Benefits of Using Superbills

Using superbills offers significant benefits for both healthcare providers and patients:

For Healthcare Providers

- Improved Cash Flow: By collecting payments upfront from patients, providers can maintain a steady cash flow and reduce financial strain.

- Reduced Administrative Burden: Providers spend less time dealing with insurance companies and can focus more on patient care.

- Enhanced Efficiency: Automated superbill generation through electronic health record (EHR) systems can streamline the billing process.

For Patients

- Reimbursement for Out-of-Network Services: Patients can get reimbursed for services provided by out-of-network healthcare providers.

- Transparency: Patients have a detailed record of the services provided and the associated costs.

- Control Over Healthcare Choices: Patients can choose their preferred healthcare providers without being restricted to in-network options.

Challenges and Solutions

Despite the benefits, there are challenges associated with superbills, including claim denials, complex coding requirements, and administrative burdens. Here are some solutions to these challenges:

Reducing Claim Denials

- Accurate Coding: Ensuring that all CPT and ICD-10 codes are accurate and up-to-date.

- Pre-Authorization: Obtaining necessary pre-authorizations for services.

- Comprehensive Documentation: Providing complete and detailed documentation for each visit.

Simplifying the Process

- Use of EHR Systems: Implementing electronic health record systems to automate and streamline the superbill generation process.

- Training for Staff: Providing training for administrative staff on accurate coding and documentation practices.

- Clear Communication: Ensuring clear communication with patients regarding the billing process and what to expect.

Tips for Patients Using Superbills

For patients, understanding how to use a superbill effectively can help ensure successful reimbursement from insurance companies. Here are some tips:

Understanding Insurance Benefits

Before using a superbill, patients should:

- Review Their Insurance Plan: Understand the out-of-network benefits, including deductibles, co-pays, and coverage limits.

- Check for Pre-Authorization Requirements: Some services may require pre-authorization from the insurance company.

Submitting the Superbill

When submitting a superbill to an insurance company:

- Double-Check Information: Ensure all patient and provider information is accurate.

- Include Necessary Documentation: Attach any additional documentation required by the insurance company, such as receipts or progress notes.

- Follow Up: Track the status of the claim and follow up with the insurance company if necessary.

Conclusion

Superbills are a vital component of the healthcare billing process, particularly for out-of-network services. They provide detailed documentation of the services provided, helping patients get reimbursed and ensuring healthcare providers receive timely payments. By understanding and effectively using superbills, both providers and patients can navigate the complex landscape of medical billing with greater ease and efficiency.

Struggling with medical billing? QZ Medx can help!